Traxia is a fintech platform

Trax allows small and medium businesses to trade accounts that can be accepted, at a premium rate, to get instant liquidity.

This is the first project set up on Cardano's platform and its move will be made by Embano, Cardano's investment incubator.

Traxia is a fintech platform that aims to ensure liquidity for small and medium businesses (SMEs) difficult to access on credit.

The idea comes from the difficulties in the real world where Finance is only 7% of short-term assets, useful for SME expansion. If so, how SMEs can access the credit that restricts the bank's ecosystem

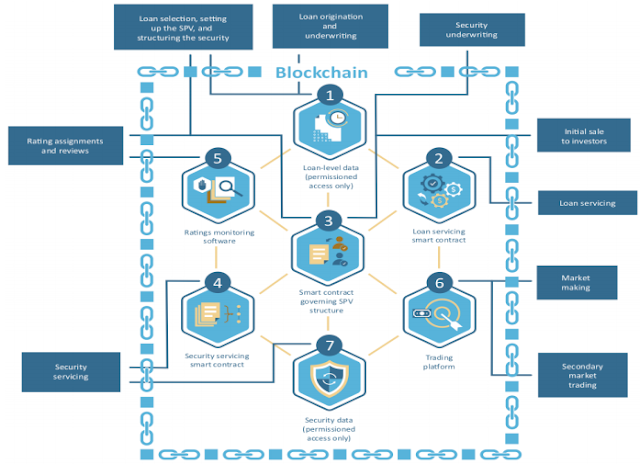

SMEs need to digitize and upload their invoices (pay 60/90/120 days) to the system and allow professional investors redeem, transform digital invoice assets. Immediately and simply by using the private key, SMEs confirm the accuracy of the invoices and receive commission minus Fiat.

On the other hand, who wants to become a technology project partner that speeds up the process, secures transactions, earns commissions. With technology partners, there are liquidity providers such as funds (ie), where financial operations in the first place receive TMT tokens and repay them in the market with smaller investors, income is spread. At the same time, there are professional investors who enter the market of a commercial invoice (digital asset) trying to get the margin.

If no additional token is released on time, the hardcap project will have a market share of approximately $ 41.4 million (4 million TMT). In the current ICO environment, the market cap is calculated to be on the higher side. There are a lot of funding needed to get a proper warehouse loan conducted by Traxia.

In the loan warehouse, Traxia can buy the receivables and hold them until the buyer buys them. In the early stages of the project, the warehouse has an important role in making matches and avoiding ecosystem congestion.

The total number of token supplies is 1 billion TMT.

Sales Token

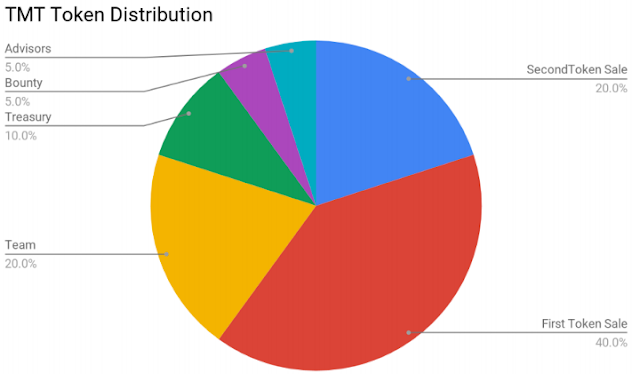

Total allocation of total Token sales is 60%, a team of more than 20%, Ministry of Finance 10%, 5% and 5% Advisory Bounty. Initial sales starts at a discount of 40% and 40% of the token price, then at a discounted price on April 18, divided into 4 stages. The minimum amount that should be monitored in the first stage of a minimum of 0.01 ETH on 19 March, 10 ET. I would like to participate in the first sale but still 10 ETH to anyone, I recommend visiting a web page , a primablock.com block created Ethereal. Cardano (ADA) can also contribute, the stamp can be achieved during pre-sale, you can avoid general sales.

On June 6, TMT plans to encourage existing trade.io and Gatecoin to be exchanged.

The token sale system is fully compliant with the rules of the regulations.

The total supply of 1 billion TMT and poor cap reached 41.4 million dollars, 11% of 64% warehouse lending, business development and sales, 15% of Smart-Contract development, legal compliance and emergency budget 5% 5% Spent It it is important to note that this ensures the activity of various liquidity providers and also uses lending Wharehousing to run the platform.

Assigning tokens and allocating funds is as follows.

The token is granted when it reaches the cover, or closing the crowd on June 2nd.

Team members, early investors, strategic consultants, token lock partners 60% for 12 months and key remaining 40% for 24 months. The Treasury Fund is also valid for two years.

Road map development

V1 (Alpha) January 2018

V1 (beta) March 2018

Monolith API (PHP), Web client (Angles 4 / Typescript)

April 2, 2018

Monolith API (PHP), Web client (Angles 4 / Typescript)

V3 June / July 2018

Micro service API (NodeJS / Typescript / GraphQL), Web client

(ReactJS / typewriter / redux), mobile client (original reactants / typewriter / redux)

Conclusion

The project is organized and supported by Cardano communities by investment base Emurgo, Shanghai Slash Edition Award recipient 2017. The development team called LiqEase is, you have a lot of records that are implemented with the launch of an independent digital project for large companies, and a deep knowledge of the world fintech. Finally, Miguel Solana from Santander Bank and Mr. Kapron from Citibank to support this project ensures long-term investment and great success in the future.

More information:

=======

==========

==============

==============

My Profile:

Komentar

Posting Komentar