eCoinomic: High Tech of Global Platform that Enables Crypto Assets as Collateral

In this modern and digital-based era, we can not deny that the advancement of technology has brought us to the next level of financial service. Blockchain technology, for example, is being implemented to support the cryptocurrency involvement until the banking and financing.

But, the existing form of digital assets cannot be used as financial assets, therefore, can not be used as collateral, and in another side, the owner of the asset need to protect their cryptocurrency with the purpose to add the value in a quick time. And that's where the eCoinomic take a part to solve the problem.

Introducing eCoinomic.net

Like what has been said before that the existing form of digital assets cannot be used as financial assets or as collateral, therefore eCoinomic.net company try to offering the new solution through creating a global platform that enables individuals and small business to used their crypto assets as collateral when they want to loan the fiat money.

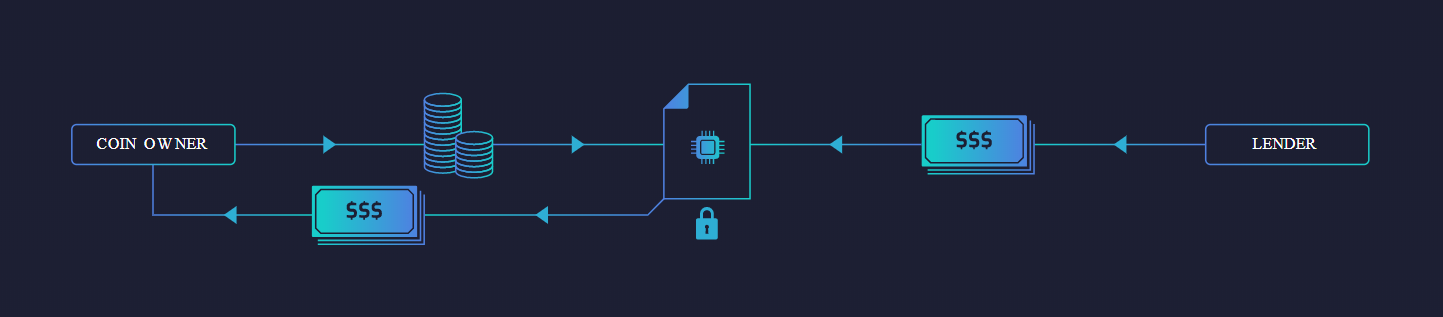

eCoinomic.net will act as a third party and will be connecting the financial institutions like investment banks, family offices, and funds as lenders and individuals or small business as borrowers. eCoinomic.net will stand out beside the financial institutions and protect them with a maximum lending procedure for minimalizing the risk that associated with it. Besides that, eCoinomic.net also offering a low-risk yet profitable investment for any financial institutions.

eCoinomic.net Ecosystem

There is two main role in eCoinomic.net network, Lenders and Borrowers. A lender is a financial institution like investment banks, family offices, or funds. They will provide the need of loan in fiat currencies and will be protected by eCoinomic.net by a maximum lending procedure to minimalizing their risk. Meanwhile, the borrowers can be individual or small business. They need the role of CNC token in order to use eCoinomic.net platform.

The mechanism for accessing eCoinomic.net is quite simple. The users have to pass the registration process which needs the law of KYC procedures. After that, the users must have the CNC tokens and be adding it to their new personal account. And after the launching of eCoinomic.net, the price of CNC tokens will be based on their exchange list, and the CNC tokens can also be used as a collateral.

The main language that will be used within eCoinomic.net platform is Python. And the platform will be based Ethereum blockchain that will be including Smart Contract program. The Smart Contract will liquidating the change from collateral form to a loan and will be paying the interest rate. The maximum amount of single loan contract in eCoinomic.net is up to USD 10.000 and the maximum period for any user to sign their contract is for 30 days. It can be further prolonged after the previous interest and services fees charged have been paid by the users.

Meet the eCoinomic.net Tokens

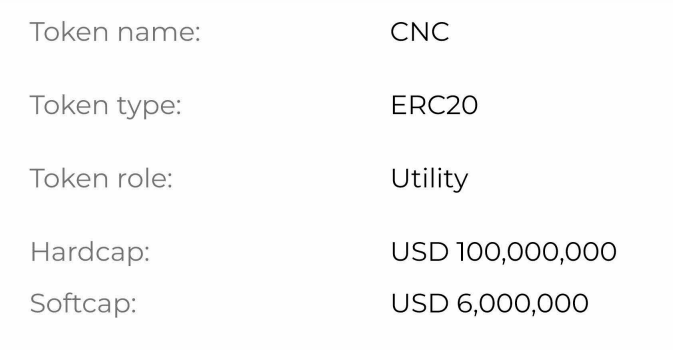

Like other platforms in cryptocurrencies world, eCoinomic.net also need the role of token that will be used to transacting within its platform. The token of eCoinomic.net can be known as CNC tokens. It's a utility token that can also be used as collateral and based on ERC20 standard which means very easy to integrate with another Ethereum contract.

The amount of CNC token hard cap is USD 100.000.000 and the amount of CNC token soft cap is USD 6.000.000. The crowd sale Development stage will be started on 3 April 2018 and will end on 21 April 2018. Meanwhile, the total supply of the CNC token is up to 2.100.000.000, and the available token for sale is up to 1.550.000.000 tokens. CNC Tokens have the list of an excluded region for their platform. The countries are the United States of America, Republic of China and Singapore.

Links:

⏩⏩ Website ⏪⏪

⏩⏩ Whitepaper ⏪⏪

⏩⏩ ANN Thread ⏪⏪

⏩⏩ Facebook ⏪⏪

⏩⏩ Twitter ⏪⏪

⏩⏩ Telegram ⏪⏪

MY PROFILE : RONDENK45

Komentar

Posting Komentar